|

01 March 2016

Posted in

sentix Euro Break-up Index News

The sentix Euro-Break-up Index (EBI) raises three points to now 19.9% in February. The latest rise marks the fourth straight increase in a row after being propelled by Greece’s return to the stage of the euro-drama.

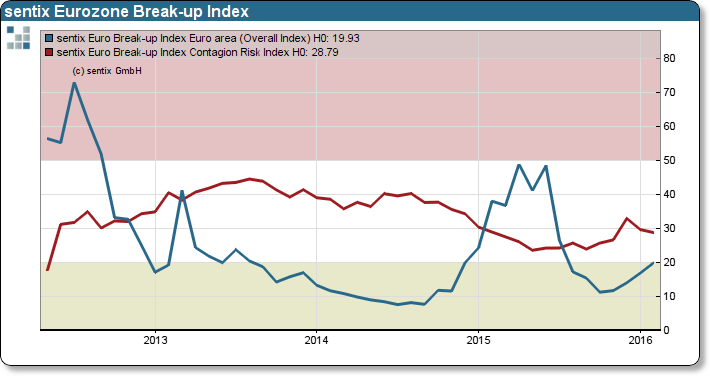

For the first time since July 2015, the sentix Euro-Break-up Index (EBI) is close to rise above the 20 percentage point watermark (+3 percentage points in comparison to previous month). In the past, values above 20% have been accompa- nied by tough media coverage about the Eurozone’s future (see chart). Alarmingly, with Greece (+4 percentage points), investors push an “old acquaintance” back in the spotlight of the euro crisis.

Moreover, concerns arise as especially institutional investors express their worries. The development of the sentix EBI shows that polled investors believe that the euro crisis is not over yet. The latest EBI value for Portugal, after having climbed to the highest reading since September 2013 (+0.75 percentage points to 3.15%), hints into a similar direction.

For this month, we only can announce positive news for Finland: After the Finnish EBI value nearly quintupled between November 2015 and January 2016, the latest reading declines against the prevailing trend by around three percentage points.