|

29 June 2020

Posted in

sentix Euro Break-up Index News

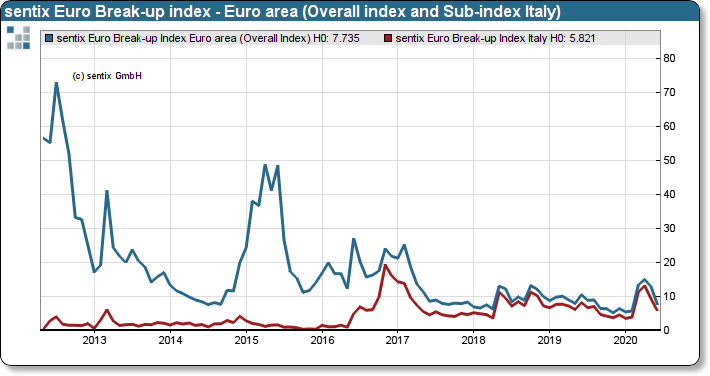

The excitement of some investors about the stability of the Eurozone, which was visible in EBI index values in recent months due to the Corona crisis and the ruling of the Federal Constitutional Court on ECB policy, has subsided again. The Euro Break-up Index fell significantly to 7.7% in June.

Two pieces of good news have reached the Euro-Zone in recent weeks: first, the corona crisis has eased at least in terms of infection numbers. The pandemic is largely under control in all EU countries. Travel restrictions have now been eased. This is particularly beneficial for the economically hard-hit countries of the Mediterranean region. On the other hand, a solution is emerging as to how the ECB will react to the ruling of the Federal Constitutional Court. A harsh confrontation can probably be avoided. Together, these two factors make investors more optimistic about the stability of the eurozone. The euro break-up overall index falls sharply to 7.7%. And the sub-index for Italy also falls to 5.8%.

sentix Euro Break-up Index: Euro area Overall index and sub-index Italy

Does this mean that the euro zone is in calm waters for the next few months? We do not think so. Because the next complaints about the ECB's euro rescue policy are on the horizon, the 750 billion euro economic programme of the EU Commission is meeting with resistance and the recession in Euroland is by no means over, even if expectations for the economy are currently rising. The volatile trend of the last three years is likely to remain with us.