|

29 April 2019

Posted in

sentix Euro Break-up Index News

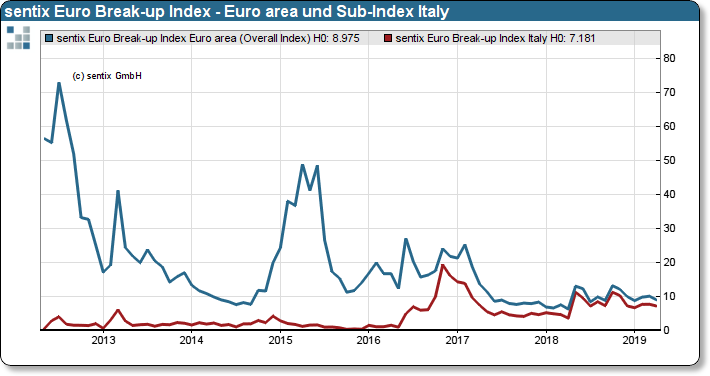

In the penultimate sentiment test before the European elections, the investors surveyed by sentix show that they are still relatively relaxed with regard to the stability of the Eurozone. The Euro break-up index for the euro area fell by slightly more than 1% to 8.98%. The sub-index for Italy also declined slightly.

The turmoil surrounding Brexit, which was initially postponed by several months, and the forthcoming elections to the European Parliament are currently rolling over to investors as "non-events". This was already evident in the sentix Policy Barometer, which showed a decreasing perception of political issues as risk factors. In fact, this is now having an impact on the Euro Break-up Index, which is falling to just under 9%. This calmness of investors is also reflected in the country indices. Italy is still the country that investors believe is most likely to threaten the stability of the Euro-Zone at the moment. But here, too, at 7.2%, we measure a value 0.5% percentage points lower than in the previous month.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

The former problem child Greece disappears more and more from the consciousness of the investors. At 2.9%, the Greek subindex is at an all-time low! All other country indices are randomly quoted at less than one percent. The next EBI survey will take place immediately before the European elections and will therefore not yet be able to reflect in-vestor reactions to the election results. This will only be possible with the data from June.