|

26 December 2016

Posted in

sentix Euro Break-up Index News

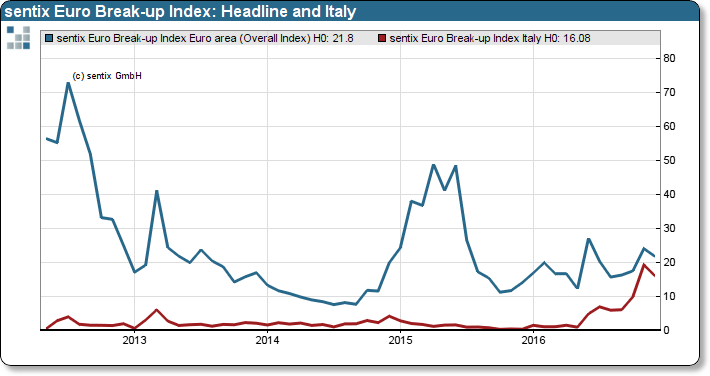

The data on the Sentix Euro Break-up Index, which was collected shortly before Christmas, show a certain relief. The fact that Italy has a recapitalization of the deprecated bank Monte dei Paschi reduces the exit probability for Italy, if only slightly. The fact that the dangers for the Eurozone are by no means banished is shown by a look at the conta-gion risk index.

Investors are again looking more confidently at the Eurozone. Shortly before Christmas, the probability of a break-up of the euro zone declines from just over 24% to 21.8%. The decline is mainly due to a reduction of break-up risks in Ita-ly (16.1%). However, Italy remains the number one euro crisis candidate number 1, even before Greece.

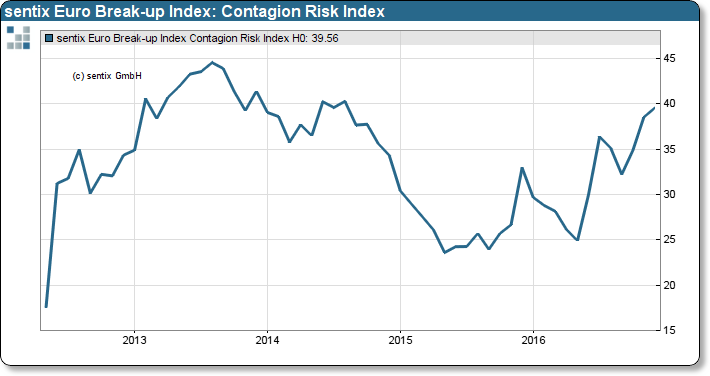

The fact that this is by no means a lasting relaxation in the euro question is shown by a look at the index for the measurement of the risk of infection. This index increases when investors think there is more than one exit candidate. Since the sub-index for Greece is rising again this month, contrary to the overall trend, this has a negative impact on the risk of infection.

This index increases accordingly (see chart below).