|

30 September 2013

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) falls again in September. It is now down to 18.75% from 20.45%. This is its second-lowest reading since its introduction in June 2012. Only in January the index stood lower at 17.15%. Nevertheless, the sentix EBI indicates that it is still about one in five investors who expects at least one country to leave the euro zone within a year's time.

The decrease of the sentix EBI occurs against the backdrop of the current negotiations concerning a new government in Germany and a call for a vote of confidence by the Italian prime minister. At the same time the problems of the Portuguese cabinet are at the moment not as strongly in the focus as over the previous months.

That the sentix EBI falls in September is mainly due to investors' judgments concerning Greece. For the Southern euro nation now only 15.6% of investors expect a euro exit within the next twelve months (after 17.4% in August). But also for Cyprus (11.0% after 11.6%) and Portugal (4.0% after 4.4%) the national EBIs recede. For Portugal it is the second decrease of its EBI in a row while the indicator still stands at its third highest reading this year.

For the two large countries of the periphery, the picture remains the one that could be observed over the past five month already: The Italian EBI displays a higher reading than the Spanish one. In September, the Spanish EBI stays at about the same level as in August, while the Italian index climbs – against the background of renewed political tensions – from 1.3% to 1.8%. If one calculates fair values (or yields) for government bonds using the national EBIs which reflect the euro-exit probability of each country, Italian government bonds look expensive in relation to their Spanish peers. (Italian 10-year government bonds currently carry about the same yield as the Spanish ones although their euro-exit risk stands at 1.8% versus 0.9% for Spanish bonds – according to the sentix EBIs.)

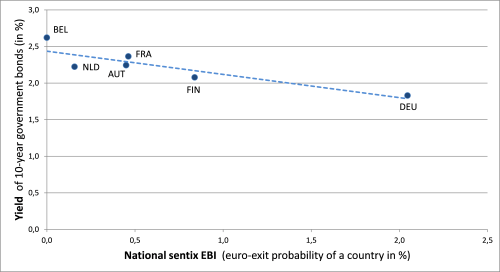

Furthermore, one week after the German Bundestag elections the national EBIs for the two core countries Germany (2.0% after 2.6%) and Finland (0.8% after 1.6%) decrease, too. That these indices do not fall even further is probably due to the prevailing government negotiations in Germany. There are two arguments in favour of even lower EBI readings for (at least) Germany: Firstly, the Euro-critic party AfD has not managed to win seats in the new German Bundestag which paves the way for stronger pro-euro zone policies. And secondly, the new coalition partner of the ruling CDU will certainly push for a euro zone-friendlier stance, too, as it will be a party of the left (Social Democrats or Greens) and not the old liberal partner (FDP) anymore (which has not managed to win seats, either). Should the German national EBI fall further, this should also mean higher yields for German government bonds – at least according to the EBI's logic (see graph). The idea is here that investors will most likely not be ready to pay such a high safety premium for German titles anymore, a premium which is founded on – amongst other things – the possibility of a freely-chosen Euro exit (out of own strength).

Annotation concerning the attached graph: On the x-axis the national sentix EBI values of the euro zone core countries (which equal their euro-exit probabilities) are shown. On the y-axis the yields of the corresponding government bonds are displayed (from September 27, 2013). It can be seen that a higher national EBI results in a lower yield investors demand for buying a core country bond. In other words, the safety premium investors are willing to pay for a government bond of a euro zone core country rises with the possibility of a euro-exit out of its own strength.

Background of the sentix Euro Break-up Index: The current sentix Euro Break-up Index reading of 18.75% means that still about one in five investors expects the euro to break-up within the next twelve months. The EBI had reached its highest reading in its 16-month history at 73% in July 2012. Its lowest reading of 17.15% was registered in January 2013. The current poll was conducted from September 26 to September 28, 2013. 884 individual and institutional investors took part in it.