“Overconfidence Index” highlights threat to bond market

Written by Julien Mueller

|

01 August 2016

Posted in

Special research

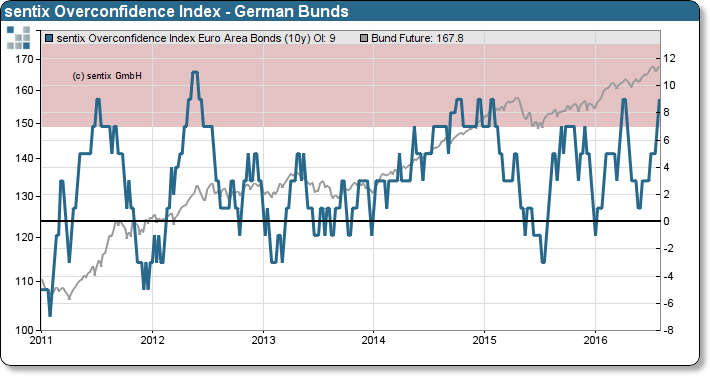

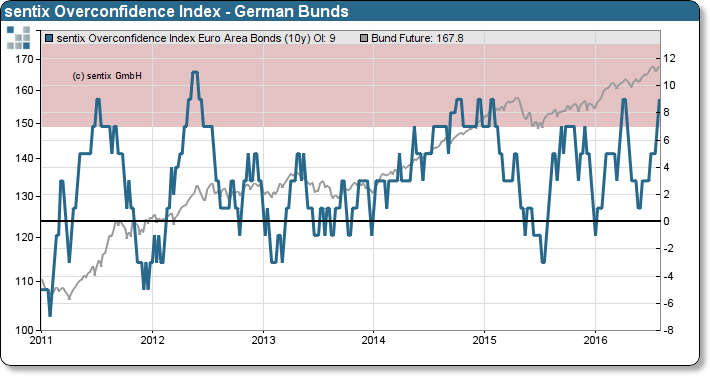

The sentix Global Investor Survey points towards mounting risk for German Bunds as the sentix Overconfidence Indicator’s +9 Points for the Bund-Future flashes warning signals. Comparable overconfidence levels have preceded market moves to the downside.

The sentix Overconfidence Index (OCI) for German Bunds rises by +2 to +9 points and penetrates the upper boundary for the first time since April. High Overconfidence Index readings provide evidence that investors have strong general perceptions that the Bund-Future is trending. Trend focused investors tend towards complacency and overconfidence (for a detailed explanation of our indicator, please refer to the Background section). Moreover, investors tend to neglect risk and position management. In such situations, the majority of investors may be caught on the wrong foot by sudden market movements.

Based on the sentix time series, strong perceptions that the Bund-Future is trending, as present in 2011, 2012 and 2015, precede downside corrections in the Bund-Future price (refer to the chart). Based on our statistical analysis, the German Bund-Future has dropped on average 1,5% within four weeks, every time the sentix OCI had reached +9 points.

Background

The sentix Overconfidence Index (OCI) shows how probable it is at a given point in time that price behaviour in a market is perceived by investors as a trend. The higher this probability, the stronger the case for investors becoming overconfident regarding their forecasting skills. In a situation of overconfidence, the probability, in turn, rises for a price movement against the trend as investors tend to accumulate excessive positions.The OCI is calculated from the price movements of the corresponding financial market. It formally reflects how often prices have risen or fallen in the proximate past. The higher the index, the more often prices have increased recently on a weekly basis. The lower the index, the more often prices have fallen. Figuratively, one could speak of a coin toss for which the indicator records how many times head or tails comes up.The OCI then illustrates the following: When one side of the coin comes up very often players would – after a while – doubt the fairness of the coin. They would believe that it is biassed. And things are quite similar in financial markets: If a market shows, for instance, significantly more price increases than decreases, investors may think the market is biassed and, thus, displays a trend – while a trending market is assumed to be much easier to forecast. Consequently, the subjectively felt confidence grows, and overconfidence arises among investors. This tends to lead to investors building up excessive positions.

The sentix Overconfidence Index can fluctuate between -13 and +13 points. Readings below -7 or above +7 indicate a high probability of investors being in a strong trend-perception phase and, thus, for a relatively high degree of complacency and overconfidence. The potential for a price movement against the trend then depends on the already accumulated investors’ positions.

The time series for the sentix Overconfidence Indices go back to June 2001.

The latest sentix, Global Investor Survey was conducted from 28-July-2016 to 30-July-2016. 989 individual and institutional investors took part in it.