|

30 September 2019

Posted in

sentix Euro Break-up Index News

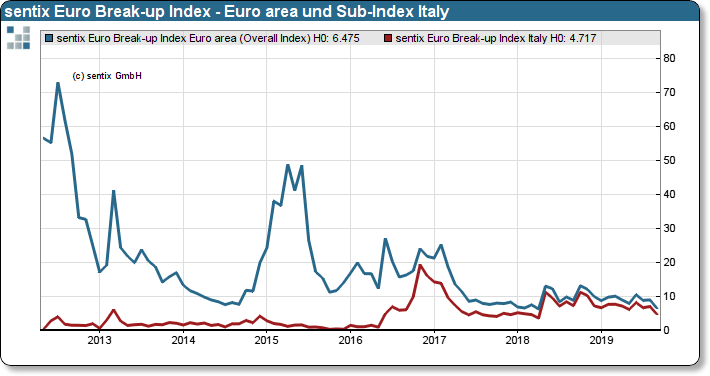

The ECB's decision to revive the bond purchase programme is probably one of the reasons why the euro break-up risk was further reduced in September. The overall index for the euro zone fell to 6.5%, its lowest level since April 2018. The sub-index for Italy also fell sharply to just 4.7%.

Mario Draghi leaves office in the same way that he has impressively buried himself in the collective memory of inves-tors: with a "whatever it takes" decision. The ECB's decision to resume the bond purchase programme indefinitely bears a similar hallmark to the decision in July 2012, when Draghi convinced the market that the ECB would save the euro "at any price". In the run-up to this measure, the markets had great doubts as to whether the euro would sur-vive. sentix started its exclusive euro survey just at this time. At that time, the risk of failure at its peak was over 70% - so Draghi did not act without external compulsion.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

It's different this time. At no time in 2019 did the Euro Break-up Index indicate an increased likelihood of the euro zone breaking up. But with Italy, there was a residual risk that a euro-wide recession could lead to another discussion on euro stability. The sentix data indicate that Draghi has once again succeeded in changing the perception of investors per euro with the current decision. Although Italy is still the biggest stability risk at the moment, it is almost at the perception threshold.