|

26 October 2015

Posted in

sentix Euro Break-up Index News

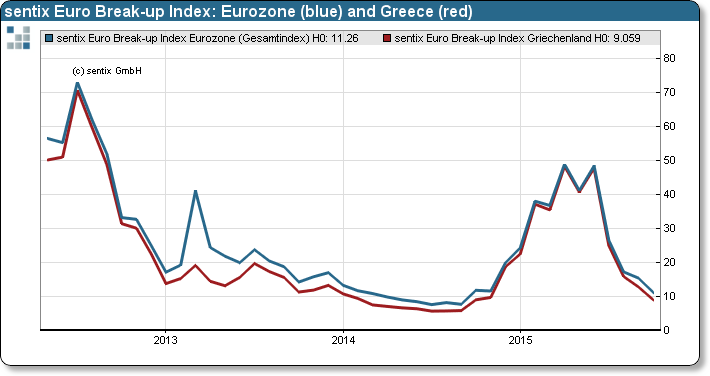

In October, the sentix Euro Break-up Index (EBI) continues to decline to 11.3%, marking the lowest reading for 2015. Despite facing a tough challenge due to Europe’s influx of migrants, the Eurozone’s stability is currently not being retested.

Although, Europe’s present refugee crisis reveals fundamental cultural as well as political differences among European nations, the stability of the Eurozone remains robust. Recent political developments overshadow all unsolved and deferred issues of the common currency. That those issues remain smoldering under the surface underline the latest European central bank’s flurry. Despite ostensible stability, the European central bank felt prompted to offer financial markets more monetary stimulus.

The decline of the sentix EBI Index to an annual low of 11.3% comes with no surprise amid a marked-guiding central bank policy. All country values lie below 2%, Greece shows still a reading of 9%. Though, the index for Greece dropped to a 52 weeks low. Comparing investors’ probability of a country’s exit from the Eurozone with government bonds to German bunds spread, the sentix EBI Index signalizes unchanged moderate performance opportunities for Greek and Portuguese sovereign bonds.