|

02 March 2020

Posted in

sentix Euro Break-up Index News

The events surrounding the spread of the new corona virus are keeping people around the world and in Europe in suspense. The new outbreak in Italy poses major challenges for the economy and the government there. For investors, however, this is not yet the start of a new round of euro uncertainty.

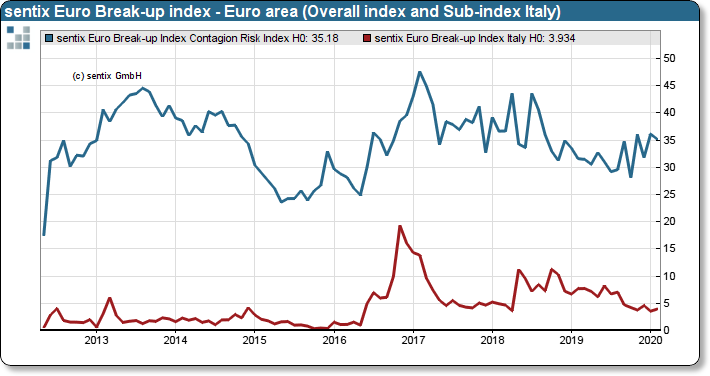

The new corona virus has hit Italy, a country in the eurozone that is already facing major challenges, at least economi-cally. The concern is that there will be significant production restrictions due to the virus, which is raging particularly in the economically strong region of Lombardy. From the point of view of the investors surveyed by sentix, however, this development has so far given no cause for concern about the stability of the euro zone. The sentix Euro Break-up overall index rises only marginally to 5.77%. The sub-index for Italy is also changing only slightly.

sentix Euro Break-up Index: Euro area Overall index and sub-index Italy

The same applies to all other states, where Greece is currently in the spotlight due to a possible resurgence of the refugee crisis. But here, too, investors do not yet see a return of insecurity.

Unfortunately, however, the same applies to the issue of euro stability as to the corona virus: there is still a risk of contagion. At 35%, the risk of contagion in the case of the euro crisis remains unfortunately in the "yellow zone".