|

27 March 2017

Posted in

sentix Euro Break-up Index News

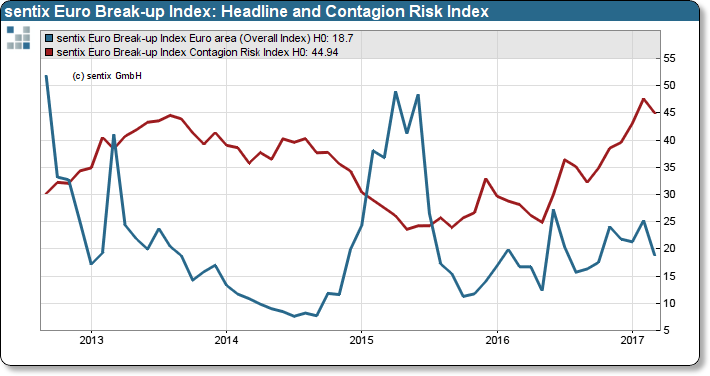

The situation in the Eurozone significantly calms after the general elections in the Netherlands. The surprising weak turnout for the Eurosceptic Wilder party is the reason for investors to reconsider their pessimism about the union. In March, the sentix Euro break up Index eases below the 20-percentage point mark. Contagion risks, in contrast, remain high.

In March, the situation in the Eurozone settles, at least on the surface, as the sentix Euro Break-up Index (refer to chart 1, blue line) drops to 18.7%. It is the first time since October 2016 that the sentix Index, which measures the probability that a member country exits the block, ranks below the 20-percentage point mark. The unexpected outcome of the general election the Netherlands put oil on troubled waters. Investors did not expect that Dutch voters defy the populistic trend in Europe. Hence at least from a Dutch point of view, voters averted the worst-case scenario of a Wilder – Le Pen axis.

Chart 1: sentix Euro Break-up Index: Headline Index Eurozone and Contagion Risk Index

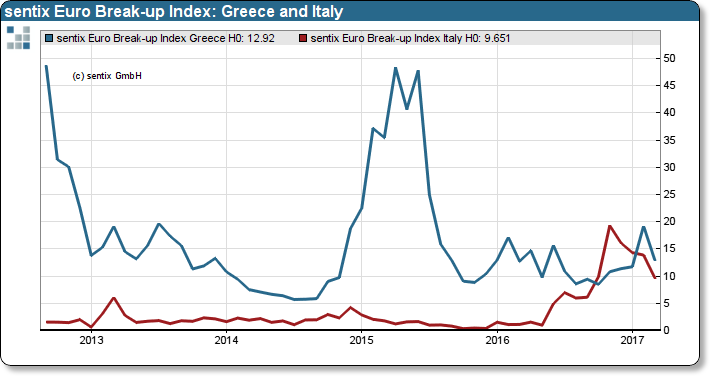

Although the Dutch election results are the main driver for reducing the exit probabilities, the effect is not limited to the Dutch sub-index, which finally drops back to 0% exit probability. Moreover, spillover effect is particularly pronounced for the Greek, Italian and French sub-indices. Last month we dedicated those a nickname: the threatening three. The exit probability based on the opinion of surveyed investors significantly falls from 14% to 10%. Greece's sub-index exhibits an even bigger decline. Exit probability drops from 19% percent in February to 13% in March (refer to Chart 2).

Chart 2: sentix Euro Break-up Index – sub-indices for Greece and the Italy

Although that the far-right populists in Europe suffered a blow in the Dutch general elections, the French presidential election remains a close call. Investors are still worried about a Le Pen victory. Therefore, it is too early to call the latest drop of the sentix Euro Break-up index a relief. The sentix contagion index remains elevated, thus, pointing towards significant risks.