|

27 May 2013

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) drops again in May, from 24.4% to now 21.9%. This is its second decrease in a row. In February and March, the index had risen against the background of the unclear outcome of the Italian elections and the irritating financial rescue of Cyprus. The current EBI is the third lowest in its one-year history. Only in January and February of this year its readings were lower.

As in the previous month, the decrease of the EBI is mainly due to investor's better assessment of the Cypriot situation. Now, only 14.8% of the surveyed investors expect Cyprus to leave the euro zone within the next twelve months. Last month it was 18.1%, in March even about 38%. Nevertheless, Cyprus remains the country with the highest national EBI.

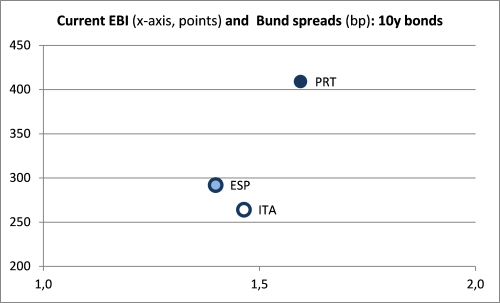

The second highest EBI on a national level is still to be found for Greece. Its index recedes slightly to around 13%. That is Greece's lowest EBI since the index was introduced in June 2012. Less tension can also be observed for other periphery countries: after the installation of a new government, the index for Italy now has come back to levels which are almost negligible. In May, the Italian EBI stands at 1.5% after 2.7% and 6.0% in the two previous months. In addition, the EBIs for Spain and Portugal decrease to levels close to the Italian one (to 1.4% and 1.6%, respectively). Against this backdrop the spread of Portuguese government bonds (over German ones) still looks to high relative to those for Italian and Spanish government bonds (see graph). Obviously, it is – as before – the lower rating of Portuguese bonds that prevents investors from buying them at a larger scale. But the EBI data show that the Portuguese spreads cannot be explained by investors' fears of a Portuguese euro exit. Consequently, government bonds of this small Southern euro country still look more attractive than their Italian or Spanish alternatives.

Against the May trend, it is the EBI for Slovenia that rises (from 2.6% to 3.9%). That means that investors now think that Slovenia is the country with the third highest probability for a euro exit. Consequently, the Slovenian EBI now is included in the calculation of the sentix Contagion Index which rises slightly. That means: among those investors who expect the euro to break up within the next twelve months there are now more who see more than one country leaving the common currency than last month.

Among the core countries it is (as last month) Germany whose EBI is an eye-catcher. It stands at 3.6% (slightly down from 4.0%) and corresponds with the votes for the euro-critic party "Alternative for Germany" ("AfD") in the current opinion polls for the German general elections later this year. It will be interesting to observe if in the coming months a correlation between the German EBI and the poll votes for the "AfD" will be established.

All in all, the data show that in May a euro break-up has become less probable from an investors' point of view. Furthermore, the quality of a potential break-up has changed. Now, the EBIs for the two heavy weights in the euro periphery stand at relatively unspectacular levels. That was not the case in the three previous months (Italy), nor was it until fall of last year (Spain)! At the same time, Cyprus, Greece, and Slovenia now show the highest EBI readings. The periphery, thus, is divided.

Annotation: A reading of 21.9% means that currently a little more than one in five investors expect the euro to break-up within the next twelve months. The EBI had reached its highest reading in its one-year history in July 2012, standing at 73%. Its lowest reading with 17.2% goes back to January 2013. The May poll was conducted from May 24th to May 25th, 2013. 951 individual and institutional investors took part in it.