|

30 December 2013

Posted in

sentix Euro Break-up Index News

Even at the turn of the year, the sentix Euro break-up index increases. The December EBI stands at 17 points. However, this is still not far away from the all time low recorded in October 2013.

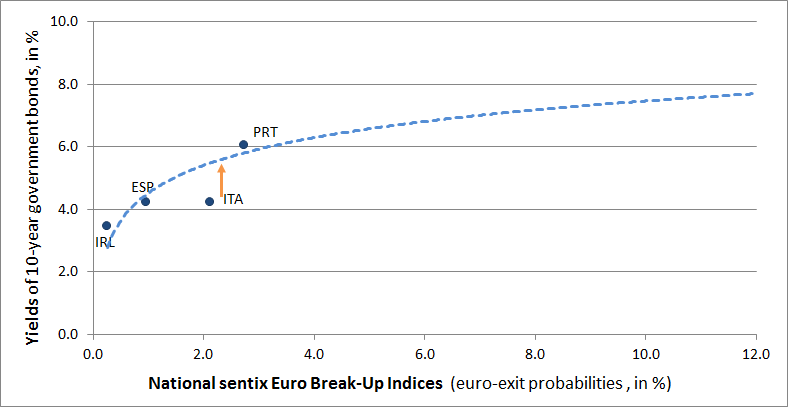

In the individual assessment of the national EBI two developments stand out. Firstly, the EBI increases for Portugal to 2.7 %. Investors are reacting to the decision of the Constitutional Court to ban a part of the austerity measures adopted. The increase is indeed remarkable in absolute terms, however, this is not a new quality for investors assessment of Portugal. In particular, if one compares the EBI development with the development of the interest rate differentials of Portuguese government bonds to German bunds, Portuguese bonds are still considered to be rated "fair" .

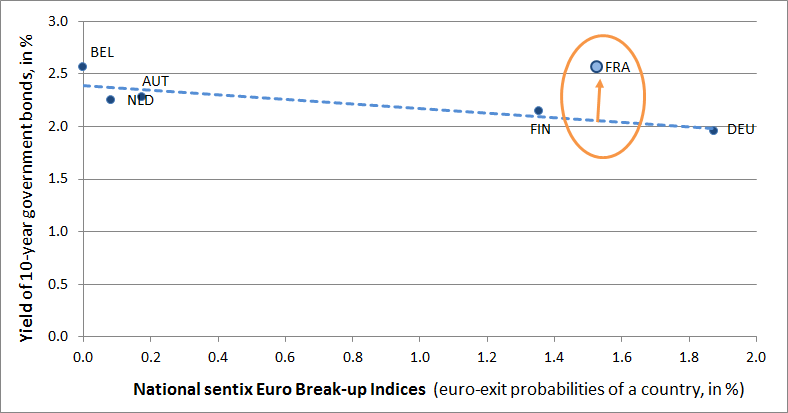

The second striking development is the renewed increase in the EBI values for France. With 1.52% the French national EBI has climbed to its highest level of the year. Despite the still low absolute values of this index, the development is nevertheless remarkable. It means that France thus removes more and more of the core zone (consisting of Germany , Austria , Finland and the Netherlands). If France would be classified as "peripheral country " also in the bond market, it would have severe consequences.

Because the bonds of core and peripheral countries behave very differently if the total EBI increases. Core countries demonstrate in such a scenario a tendency to falling interest rates , while the interest rates of the peripheral countries rise when the EBI rises. France currently enjoys the relative calm in the euro zone, which so far prevents the bonds of the "Grande Nation" coming under serious pressure. However, neither the politicians nor the investors should take this development lightly.

Explanation on the graphics: Plotted on the x -axis are the national sentix EBI of the core countries of the euro zone that each specify their euro-exit probability. The yields on 10-year government bonds found on the y-axis (as of 30.12.2013 ) . It is found that the higher the national sentix EBI the lower the yield , which require investors for government bonds of the country concerned . An increasing national EBI thus decreases the risk premium investors demand for that country.

Explanation on the graphics: Plotted on the x -axis are the national sentix EBI of the periphery counties of the euro zone that each specify their euro-exit probability. The yields on 10-year government bonds found on the y-axis (as of 30.12.2013 ) . It is found that the higher the national sentix EBI of a peripheral country, the higher the yield investors demand for the government bonds of the country concerned . An increasing national EBI therefore increases the risk premium investors demand that for a country.

Background on the sentix euro break-up Index: The current value of the monthly sentix euro break-up index of 17% means that currently about 17% of all respondents expect the departure of at least one country from the euro zone over the next twelve months. The current survey was conducted from December 26th to December 28th.760 private and institutional investors were involved.