|

26 January 2015

Posted in

sentix Euro Break-up Index News

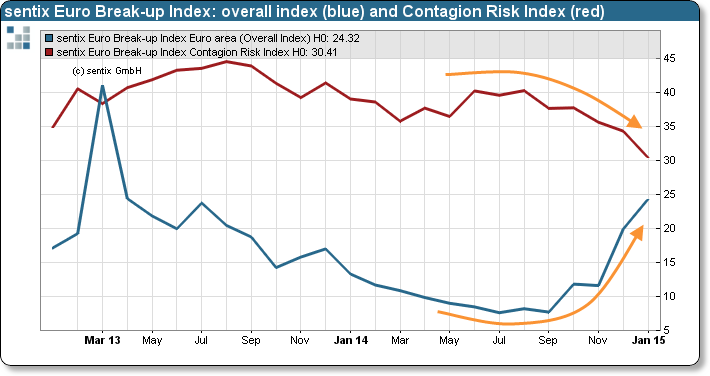

In January, the sentix Euro Break-up Index (EBI) increases by 4.4 percentage points to now 24.3%, its highest reading since April 2013. It is still the situation in Greece which drives the indicator. But interestingly, investors barely see a risk of contagion anymore – an environment which makes government bonds of the periphery vulnerable.

The sentix Euro Break-up Index (“EBI”) rises from 19.9% to 24.3% at the year’s start and reaches its highest reading since April 2013, a time when fears surrounding Cyprus were weighing on the indicator. The current reading means that about one in four investors expects at least one country to leave the euro zone within the next twelve months. On a national level, it is almost exclusively Greece which makes investors nervous as about 92% of those investors who expect a euro break-up name the Southern country as an exit candidate.

While investors show some nervousness regarding Greece just ahead of the parliamentary elections (the sentix survey closed on Saturday evening), they are barely worried about contagion effects following a potential “Grexit” (see graph). The sentix Contagion Risk Index falls by almost four points to 30.4, the second-lowest reading since its introduction in June 2012. Consequently, market participants increasingly perceive Greece as an isolated case. This calmness hides a potential for negative surprises concerning the spreads of periphery countries as it is still a long way for the “troika” and the new Greek government to reach an agreement regarding the future financing of the country.

Positively outstanding among this month’s EBI data is, once more, Portugal whose EBI decreases against the general trend from 1.3% to 1.1%. At the same time Portuguese government bonds dis-play clearly higher yields in relation to most other countries, especially relative to Italy. As a result, the sentix EBI data renew their signal for an outperformance of Portuguese bonds. For the rest of the periphery, however, we expect temporarily rising spreads in the face of the coming negotiations in Greece.