|

31 May 2016

Posted in

sentix Euro Break-up Index News

The sentix Euro Breakup Index (EBI) for may reflects improvements within the euro zone. Based on declining stress levels in the euro-periphery investors perceive the odds continue to shift in favour for the cohesion of the single currency area. However, a potential “Brexit” would cause significant turmoil.

The sentix Euro-Break-up index (EBI) reaches with 12.3% the lowest level in six months. Based on positive developments of the situation in the euro periphery, investors risk perception lightens. The EBI sub-index for Greece notably improves from 14.7% to 9.8% in May. Subsequently, investors believe that the agreement reached between Greece, the EU, and the IMF could reduce contagion risks further and stabilise the struggling member country. As a consequence, the sentix risk of contagion index falls.

Unfortunately, as break-up threats continue to decline in the periphery, investors shift towards problems in France. The effectiveness of the strike tactics of some groups within France lets investors remodel political risk assessments in their investment scheme. The EBI sub-index doubles to nearly 1.3% - the highest level since March 2015.

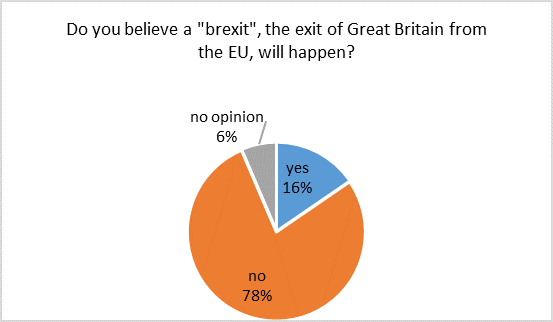

By lower EBI risk levels, investors furthermore reduce the odds that the UK will leave the EU in June. Merely, 16% of survey participants currently think that a “Brexit” is going to take place; down from 27% in April. Comparable market polls in the UK suggest higher probability for a “Brexit.” An imminent risk exists that the 968 mainly German speaking sentix participants underestimate the likelihood of a “Brexit” systematically. If indeed a Brexit takes place, the market is likely to panic. As among other things, the only 9% share of institutional investors expecting a “Brexit” highlights the apparent surprise potential.

Opinion polls state that 18-45% of respondents would see the UK to depart in June. In contrast, investors are aware of the negative impact on financial markets. On average 60% of respondents believe that all asset classes would be adversely affected. In April, investors were still relatively optimistic on real estate and bonds. In May, however, 64% and 60% of investors believe that real estate and bonds values would plunge.