|

25 November 2013

Posted in

sentix Euro Break-up Index News

After three consecutive declines the sentix Euro Break-up Index (EBI) rises from its October all-time low of 14.25% to now 15.8% in November. This is still its second-lowest reading since the launch of the indicator in June 2012. The sentix EBI shows that currently about one in six investors expects at least one country to leave the euro zone within a year's time.

A look at the country level makes clear that this month's increase of the sentix EBI is mainly caused by higher national readings for Italy (where recession lingers on), Germany (where government negotiations do not end), and Greece. For these three countries the national EBIs all rise by 0.6 percentage points. While the indices for Italy and Germany go up from 1.7% to 2.3% in tandem, the Greek EBI climbs on a much higher level to 11.9%. As a result, Greece remains the country for which most investors expect a euro exit within a years' time.

At the same time there are some countries whose EBIs decrease this month. But the observed declines are rather small. Worth of note is nevertheless the development of the EBI for Portugal. It recedes – against the general trend – for the fourth time in a row and now stands at 1.9% (after 2.1%). More positive news comes from Spain for which the national EBI reaches an all-time low of 0.7% for the second month running. In addition, for Spain there is now no single investor in the institutional camp anymore to expect it to exit the euro in the coming months!

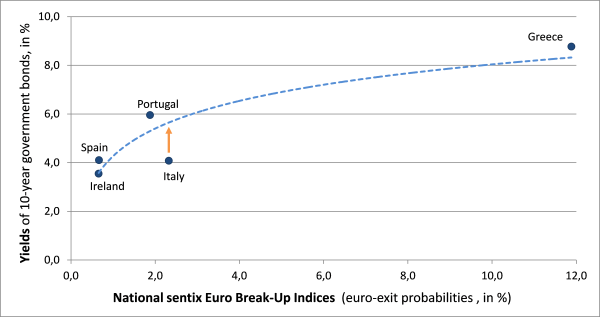

Against the backdrop of the good developments of the Iberian countries the increase of the Italian index stands out negatively. If one takes the national EBIs as yardsticks, Italian 10-year government bonds now look much too expensive when compared to their equivalents from Spain or Portugal (see graph). This discrepancy could be observed in the past months already but it has now become even more obvious: in November, both the Spanish and the Portuguese yield stand at a higher level than the Italian one – although the national EBIs of the former both display readings below the value for Italy. Even if one allows for liquidity premiums to have an influence this phenomenon more and more looks like a relative mispricing which will probably not be dissolved in favour of the Italian titles.

Furthermore, one has to pose the question if new euro zone problems are currently arising: last month investors' perceptions worsened markedly for France, for the first time since the inception of the EBI: the French index then jumped over the 1%-line where it stays this month, too. And now, in November, investors pay again more attention to the Italian problems. For instance, Italy has not – as opposed to Spain and Portugal – managed to end its recession last quarter. Still, these developments for France and Italy do not appear spectacular so far. But they could soon turn into the beginning of a new round of euro or euro zone pessimism. As other sentix data show, the general conviction for the common currency, for instance, is already fading.