|

28 January 2019

Posted in

sentix Euro Break-up Index News

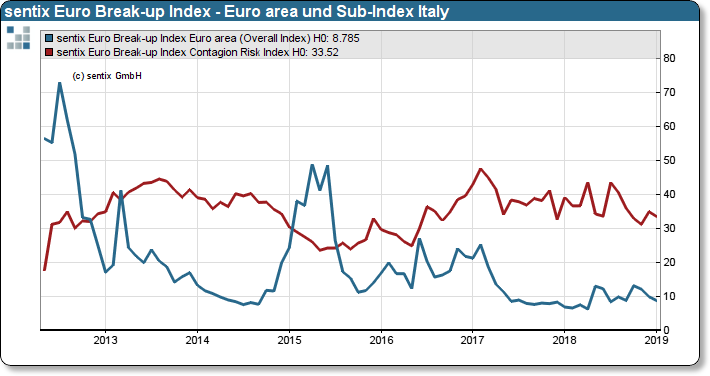

The euro zone is experiencing a quiet start to the new year. Although investors are worried about the global and Eu-ro-Zone economic outlook, this is not having a negative impact on their perception of Euro-Zone stability. The Euro Break-up Index fell slightly from 9.9 to 8.8 points. Perhaps this is also due to the relative calm on the Italian govern-ment debt front, where the sub-index for Italy is also falling.

Another reason for the comparatively positive development of the sentix Euro Break-up Index is probably the Brexit. The more chaos and inability to make decisions become visible in the United Kingdom, the stronger the will of the remaining EU states to avoid a repetition seems to be. It is questionable, however, whether such a consideration is really effective and whether it will last long after the Brexit is completed on 29 March. After all, with the European elec-tions in May there is another date on the agenda which offers all EU states an incentive to avoid unpleasant discussions. But issues such as the budget dispute in Italy or a monetary policy in the event of a sustained economic down-turn are by no means solved forever.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

At 33.5%, the sentix index for the risk of contagion is by no means as low as the overall index might suggest. The traffic light for the euro zone is not red, not green when it comes to contagion effects. She stays on yellow.