|

29 March 2016

Posted in

sentix Euro Break-up Index News

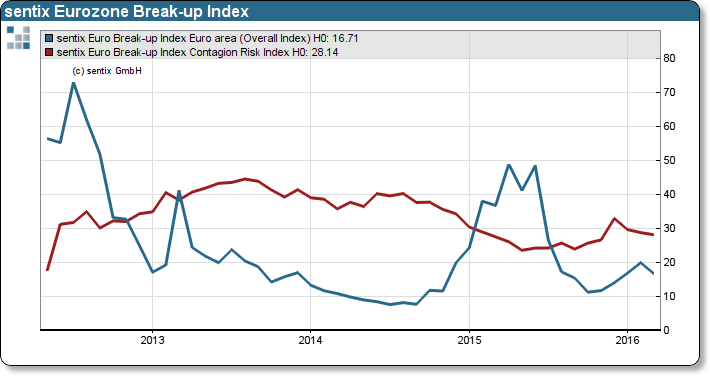

The sentix Euro Break-up Index (EBI) has surprisingly fallen to 16.7 points in March. This reflects the first reduction in Eurozone skepticism since six months ago. Risk reduction has been propelled by a more bullish view on Greece’s perceived current situation.

The sentix Euro Break-up Index slides by 3.2 points to currently 16.7 points in March. Hence, the risk of a potential break of the symbolic 20 points mark has been contained for now. In the past, EBI values above 20 points were suc-ceeded by subsequent crisis summits of the Eurozone community. Furthermore, investors review the current risk of contagion lower than a month ago. Under consideration of the latest developments on the European continent, in-vestors communicate an impression that the public solidarity messages of the Eurozone leaders are credible, thus re-ducing the risk of Eurozone break-up. A positive Signal that benefits especially battered Greece. (EBI reduction by -4.4 points).

However, risks have not vanished yet. Comparisons of member countries’ EBI values with their 10-year government bond yields reveal that Portuguese and Greek yields are still too high. Investors willing to take risks could exploit an opportunity.