|

30 November 2020

Posted in

sentix Euro Break-up Index News

While the euro countries continue to grapple with the Corona pandemic and believe that the pandemic situation can only be brought about under the control of a second "lockdown", the ECB is finding it easier to organise euro cohe-sion. The sentix Euro Break-up Index remains at a low level.

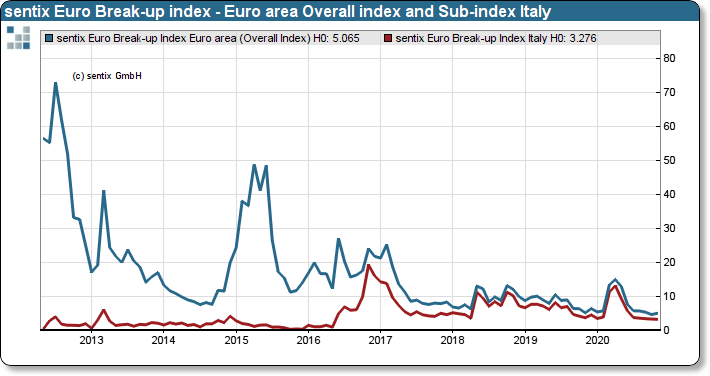

The pandemic situation in Europe is a challenge for governments and a considerable burden for citizens and the economy. This is a serious challenge for the cohesion of our societies. The situation is somewhat simpler for the ECB. At least, investors do not currently see any major risk that the crisis will put the euro-zone in serious danger. This is probably also related to the ECB's clear positioning. At the last ECB meeting, President Christine Lagarde made it clear that the ECB would do everything in its power to support the "next generation EU" project to the best of its ability. To cushion the consequences of the current economic crisis, she also held out the prospect of further monetary easing. This is what investors like to hear and with it the sentix Euro Break-up Index for the euro zone at a low level of just under 5.1%.

sentix Euro Break-up Index: Euroland Overall index and sub-index Italy

The situation is no different with regard to the likelihood of individual countries leaving. Italy continues to have the highest rate, at around 3.3%.