|

27 June 2016

Posted in

sentix Euro Break-up Index News

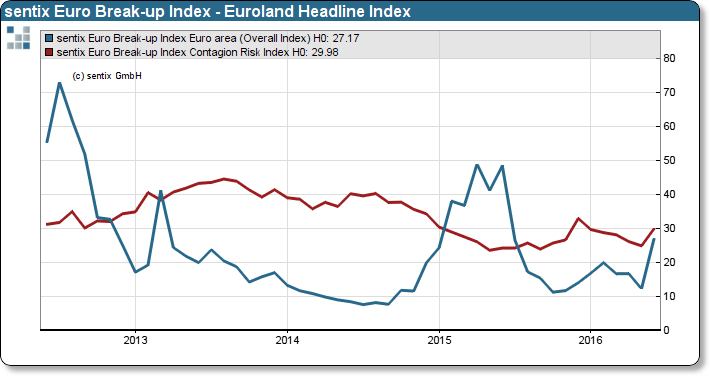

The unexpected vote of UK citizens wanting to leave the European Union, is also likely to hard shake the foundation of the euro again. Almost a third of investors responding in the sentix survey hold it again possible that the euro zone could break up within twelve months. In addition, new exit candidates appear on the horizon.

As part of our regular Euro Break-up survey we couldn’t be better in the timing. However, that it would come to an earth-shaking decision of the British people, was recently become unlikely. The stronger is the shock of the surveyed sentix investors to this event. Naturally it comes in such a situation that people might overreact. We therefore have the vote of the more than 1,300 investors surveyed evaluated separately in time and present you the results divided into three phases:

- Phase 1: The day before the referendum (since sentix starts the survey for private investors on Thursday af-ternoon, appropriate information for this group of investors are available)

- Phase 2: The first few hours after the referendum (these represents the first impulses of investors, consider-ing the votes that have been submitted until 10.30 am on Friday)

- Phase 3: The time after the phase 2 until the end of the poll on Saturday

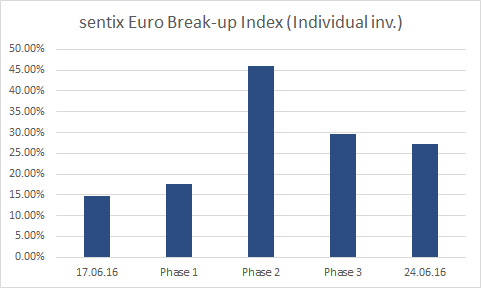

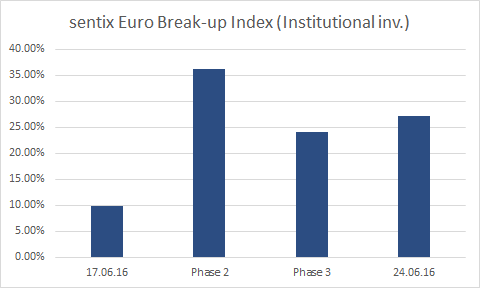

Let us first consider the total value of the sentix Euro Break-up Index (by type of investor):

Without the Brexit-decision, the EBI would have hardly changed appreciably (see Phase 1 of the left-hand panel). The immediate reaction to the news that it actually comes to the Brexit has then led to a shock-like increase in the per-ceived Break up probability (Phase 2). In the following hours, the people have calmed down, but it remains a signifi-cant increase in the EBI-value from 12.3% to 27.2%.

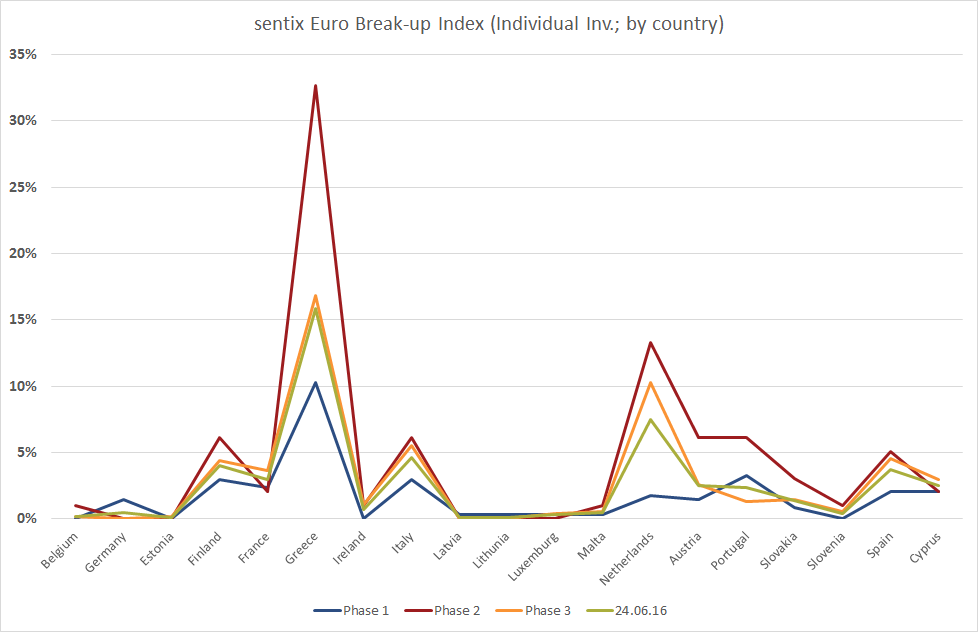

Who believed that it is the well-known countries that are traded as an exit candidate again, sees himself confirmed only partially. As an example, we consider the national EBI values again divided according to the phases 1-3. We look at the expectations of private investors. The values of the professional investors do not differ fundamentally.

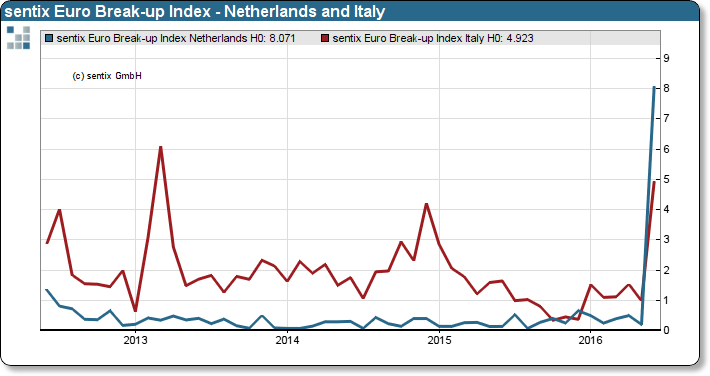

In principle, the reaction of the national EBI values corresponding to the pattern in the overall index. But there are some interesting differences. First, especially the values for the Netherlands rise by leaps and bounds and recover far less than signaled by the overall index. The same applies to Italy and Spain, although the EBI values here are consider-ably lower than those of the Netherlands. Second, Greece remains in focus, but Cyprus is not. Third, the German EBI values surprise through their complete invisibility.

At times of the debt-driven euro crisis, German EBI values always were at elevated levels. Investors felt that in the discussion on money and debt it might be Germany that leaves the euro club if it would not do the Greeks. The Brexit is clearly seen as a different kind of a problem, primarily a politically one. Here it appears for investors highly unlikely that Germany would act in any way as a driver of a Euro-negative development. This might be an important message for the capital markets, as German Bunds are far less likely drag "honey" out of the crisis, as was the case in the Greek drama.

On balance, however, the Brexit referendum has increased not only the likelihood of a breakup of the euro, but also increases the risk of infection. The sentix Contagion Risk index jumps from 24.9% to 30%. Through the Brexit vote, the euro area is now subjected a tough endurance test and political risks are back on the Euro agenda again. And this at a time where the Federal Constitutional Court has withdrawn the instrument of the "OMT" from the ECB practically.