|

14 March 2016

Posted in

Special research

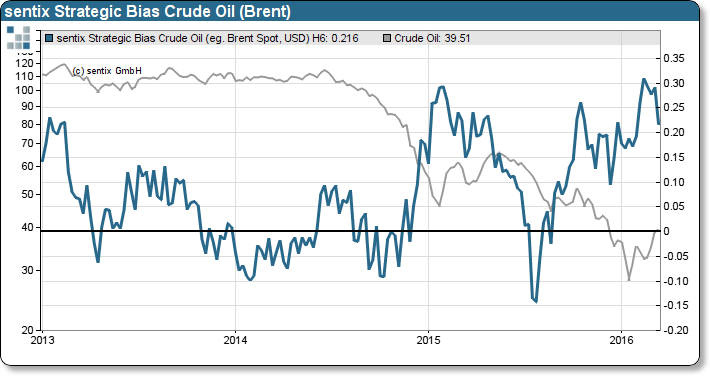

Investors’ medium term market confidence towards Brent crude oil drops surprisingly significant. That means mounting trouble for markets as investors’ willingness to sell is on the rise. The sentix indicator hints to falling crude oil notations.

The latest sentix Strategic Bias for Brent crude oil drops surprisingly significant. The sentix indicator measures the medium term market confidence on a six-month view of surveyed investors and indicates the general willingness to buy or sell a security. As a matter of fact, the since October 2015 rising Strategic Bias has led investors to a massive built-up of long-bets on rising Brent oil prices. Thus, the latest rise in investors’ willingness to sell gives reasons to worry (see chart). To a great extend the price of crude oil is determined by the commitment of traders. In turn, develop-ments of the sentix Strategic Bias usually precede changes in the commitment of traders. A worsening in investor confidence tends to result in falling Brent prices.

Furthermore, bullish investors will find it hard to build up additional long positions. Hence, the recent crude oil rally should run out of fuel soon as investors tend to secure hard earned profits.