|

02 November 2015

Posted in

Special research

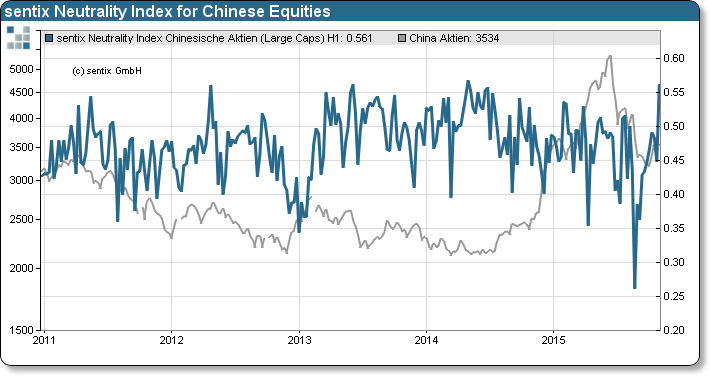

Investors’ uncertainty about the Chinese equity market index CSI300 mounts to a 52 weeks high. The sentix Global Investor Survey shows that investors react paralysed to recent Chinese macroeconomic environment.

The latest sentix Neutrality Index for the Chinese equities market, which captures the percentage of investors indifferent to current market conditions in China, reaches the highest reading since 52 weeks (please see Chart, blue line). In the past four to six weeks, the investors’ sentiment towards Chinese equities was significantly more optimistic than recently. Intriguingly, neutrality has more than doubled since mid of August 2015. Chinese stock market’s rapid recovery affected investors twofold: it ended market’s oversold status. Though, apparently have seeded disbelief as well as lack of orientation among investors concerned with the long-term market perspective. The recent “summer-crash” experience has deeply anchored. Moreover, suspiciousness finds futile ground as news about China’s “weakening” economy hit the tickers. High sentix Neutrality index readings are indications of upcoming market volatility, accompanied by repositioning.

Relevant from a technical analysis perspective is whether the CSI300 successfully crosses the resistance at 3650 points at a first lunge. Conversely, the support at 3400 points must counter a failed attempt.