|

15 June 2015

Posted in

Special research

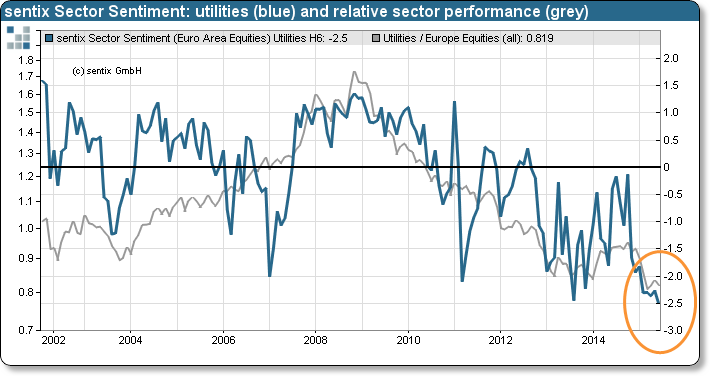

sentix Sector Sentiment for utilities falls to a sector-specific all-time low. Only once before since 2002 was the mood for a sector worse among investors. But in relation to the whole market European utility stocks’ performance has stabilized since March. All in all, the signals point to a renewed contrarian opportunity.

In June – just after the G7 “climate” summit in Elmau, Germany –, sector sentiment for European utility stocks falls by 0.23 to only -2.50 standard deviations (see “Background” on page 2). This is an all-time low for the indicator whose history goes back to the year 2002. Only once during that period sentiment was worse among investors for a sector. That was for banks in May 2012, some weeks ahead of Mario Draghi declaring the euro for “irreversible”.

When investors have turned their backs at a sector in such an extreme way, this usually is a sign for a coming outperformance – for utilities this was the case in mid-2014 (see graph), for the aforementioned bank shares it happened in 2012, too. In addition, utility stocks’ relative performance finds itself in a constructive phase of bottom building since March. If the sector is also going to outperform in absolute terms will depend on the critical level of 312 points for the Stoxx-600 sector future – a mark which is currently endangered by the significant weakness of German utilities.