|

19 June 2017

Posted in

Special research

Investors continue to show a relatively high appetite for risk in equities. This statement means less absolute positioning levels in stocks, but the structure and pattern of action. Above all, equities of small companies are still favoured by investors, and price gains are increasingly being used as an investment objective. In addition, investors are acting increasingly pro-cyclical.

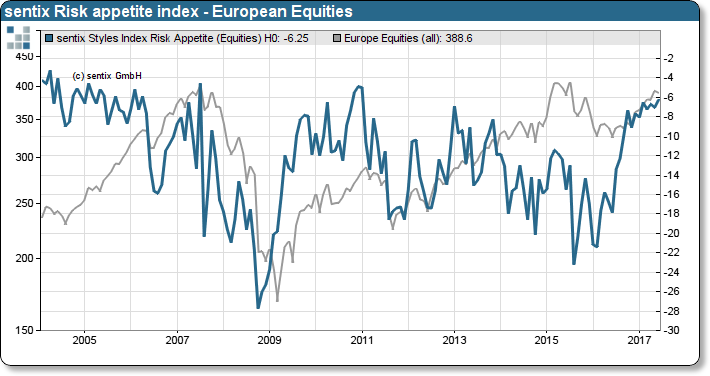

The sentix index for risk appetite of investors assesses the investor behavior in the equity market in relation to the willingness to take risks. Investors can take risks not only by the extent of their equity exposure but also by the structure. The current survey shows that the risk appetite again rose slightly in June. The reason for this is that with the end of the dividend period in Europe, the motto "price gains" is coming more strongly into the foreground. In addition, investors are making an increasingly pro-cyclical move towards the prevailing trend. Investors' interest in smaller companies remains high. This focus on "small caps" is also a sign of risk-taking.

sentix Styles Index – Risk appetite European Equities

In the past, a high level of risk-taking has often been a harbinger for corrections. This time the response may be delayed as investors are only "average" invested in absolute terms and the alternatives are missing for many investors on the face of the zero-interest rate environment.