|

19 December 2016

Posted in

Special research

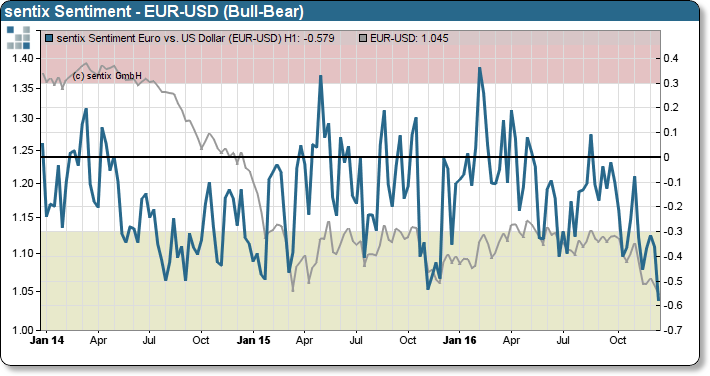

The sentix Sentiment for the Euro US-Dollar exchange rate plunges to an all-time low. The diverging monetary policies of the Fed and the ECB wreak havoc not only on the Euro exchange rate but also on investors’ sentiment. Market participants should brace for further Euro weakness.

The US-Dollar has gained in recent days due to diverging monetary policy across both sides of the Atlantic. While the ECB holds rates steady at 0% and extends its asset purchasing program in December, the Federal Reserve tightens rates by 25 basis points. Also, the forward guidance of three Fed rate hikes in 2017 caught investors by surprise. At the same time, the yield spread on 10-year US Treasuries and German Bunds has widened to 230 basis points in December, the largest spread since 1989. Investors sentiment freezes as the Euro US-Dollar exchange rate slips towards parity. Almost 65% of survey participants indicate that they are now “bearish” (pessimistic) towards the Euro. Only 7% of investors remain “bullish”. Pessimism has more than doubled in comparison to the previous month.

Technically, extremely negative sentiment readings are an indicator for an overstretched market and a contrarian buy set up. However, investors currently do express not only a negative sentiment towards the euro but also a lower confidence in the single currency as the balance shifts towards the US-Dollar. Based on positioning data provided by the CFTC, investors’ portfolio rebalancing – in contrast to a similar situation in 2014/15 - still lags investors’ market view.

Hence, we expect the rebalancing process to last until investors regain confidence in the euro currency.