|

25 September 2013

Posted in

Special research

Against the background of improving economic expectations sentix Sector Sentiment (for European stocks) rises for cyclical sectors in September. In contrast, some "old darlings" like "food and beverage", "health care" and "personal and household goods" now lose support.

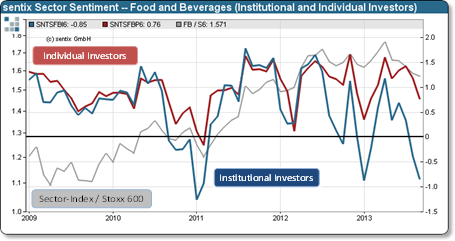

Institutional and individual investors are not always of the same opinion. And it happens rather often that institutional investors detect new trends before individual ones do. Thus, the difference between institutional investors' sector sentiment and individual investors' sector sentiment in many cases serves as an early indicator for the developments of sector indices (for stocks). Consequently, the sectors "food", "health care" and "personal and household goods" will have a hard time in the coming weeks. An underperformance against the market-wide index is quite probable. This is what sentix Sector Sentiment tells us in September as institutional investors' sector sentiment for the three sectors falls markedly while individual investors' sentiment remains on much higher levels. As a result, the spread between the two investor groups' sector sentiments rises further. This difference is most pro-nounced for "food and beverages" as can be seen in the attached graph.

What is behind these developments? The outperformance of the three sectors during the past few years – which were dominated by the debt crisis – have made investors' darlings out of "food and beverages", "health care" and "personal and household goods". The sectors' shock-resistant business models were promising stable returns in an environment full of uncertainties. Now, crisis fears are receding, and other sectors come back into focus. But many investors do not want to see this, their perception has become selective. When these market players will finally realise – over the coming weeks and months – that the three sectors continue to underperform they will probably change minds. Many investment professionals have already started to shift their preferences away from them, others, above all individual investors, will follow. This will then put their former darlings under additional pressure.

Background: The current sentix Sector Sentiment survey was conducted from September 19 to September 21, 2013. 897 individual and institutional investors took part in it. sentix Sector sentiment is a monthly survey which is conducted since 2001 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalized over all sectors and calculated as so called z-scores. A value of +1 for a sector means, for instance, that the sector is valued one standard deviation above the mean over all sectors.