|

08 June 2015

Posted in

Special research

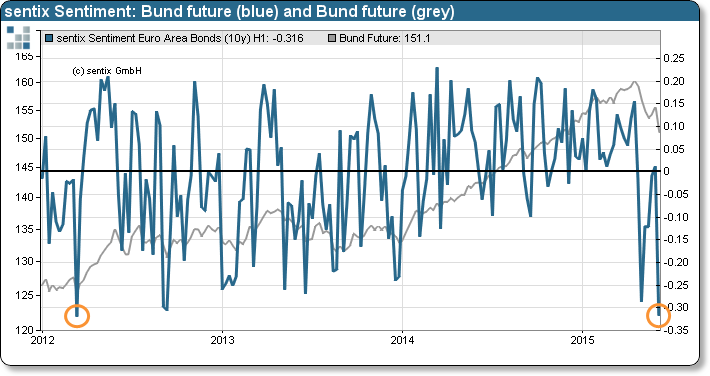

sentix Sentiment for the Bund future falls to its lowest level since March 2012 when the Greek debt was restructured. In the past such a bad sentiment among investors subsequently has led to a rise in the Bund future. This time, too, we interpret the extreme reading as a contrarian signal!

This week sentix Sentiment for the Bund future – polled via the latest sentix Global Investor Survey – collapses. Its current reading of -32% is as low as it last was in March 2012. That was the time when Greece was restructuring its debt held by private investors (so-called “private sector involvement”), and when German government bonds benefited heavily as safe-haven investments (see graph).

In the past such an extreme pessimism among investors was usually the starting point for a rally in the Bund future. And we also interpret the current sentiment low as a contrarian signal, all the more as other sentix data show that investors’ basic conviction for the Bund future is again on the rise. Consequently, the Bund future should show some strength in the weeks to come – once more at a time when Greek government finances are at the crossroads.