|

12 November 2013

Posted in

Special research

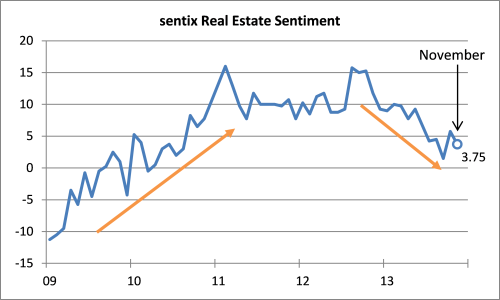

Sentiment among European investors for the real estate market – one of their darlings in times of financial crisis – is back in decline. That is showing sentix Real Estate Sentiment which falls by two to now 3.75 points in November.

Its decrease is especially noteworthy, as (nominal) interest rates have been falling lately. Usually this has positive effects on the sentiment for the asset class as it makes refinancing less expensive and in most cases leads to higher real estate prices. But at the same time investors currently do not perceive risks of inflation anymore. On the contrary, media and market participants are discussing the dangers of deflation since recently. And deflation poses – via increasing real interest rates – a threat to the real estate market. This potential burden seems to outweigh the benefits from falling nominal rates in the eyes of investors at the current juncture.

In October the picture was still different. Then it looked as if the sentix Real Estate Sentiment would be able to stop its downward trend from about a year ago. But this month now marks a setback: The indicator falls again, and stands at its second-lowest reading this year. At 3.75 points it is still in positive territory where the majority of investors display a bullish stance vis-à-vis the asset class. But the zero line – a reading below it was last recorded in March 2010 – has again come close.

sentix Real Estate Sentiment (for which data are collected since 2008) has so far reached its high at 16 points in February 2011. Since then it remained at reasonable levels before starting to decline at the end of 2012. This year investors seem to say goodbye to their long term darling, the real estate market – sentiment has been worsening continuously, one exception being last month.

Background:

sentix Real Estate Sentiment is surveyed on a monthly basis and part of the sentix Asset Class Sentiment survey which is regularly conducted around the second Friday of each month. Other indicators of the sentix Asset Class Sentiment family of indices are sentix Commodity Sentiment, sentix Credit Sentiment, sentix Emerging Markets Bonds Sentiment, sentix Emerging Markets Equities Sentiment, and sentix IPO Sentiment.

Participants in the sentix surveys on asset class sentiment may choose a category from a range of 1 to 5 to show how inclined they are towards an asset class in relation to another. The indicator may fluctuate between -100 and +100 while the third category (category number 3) of the given range marks the zero line.

The current survey was conducted from November 7 to November 9, 2013. 915 investors (of which 231 institutional ones) took part in it.