|

20 November 2013

Posted in

Special research

In November, sentix Sector Sentiment for Europe rises markedly for the old sector darlings "Food and Beverages", "Health Care", and "Personal and Household Goods". This occurs against the backdrop of a renewed confidence in the liquidity provision of central banks. Just a few weeks before Christmas, a strong increase in sentiment can also be observed for retailing. Sentiment here even reaches an all-time high.

Over the past months sentiment for the European stock sectors of the old crisis favourites "Food and Beverages", "Health Care", and "Personal and Household Goods" was weak. Now it bounces back strongly, while the corresponding sector indices have been outperforming the market as a whole. The surprising interest rate cut by the European Central Bank has certainly helped in this context: the rate cut has signaled to investors that the "old world" of ultra-loose monetary policy will last longer than previously thought. As a reflex, investors' sentiment rises for those sectors that were en vogue before the "tapering" debate had started.

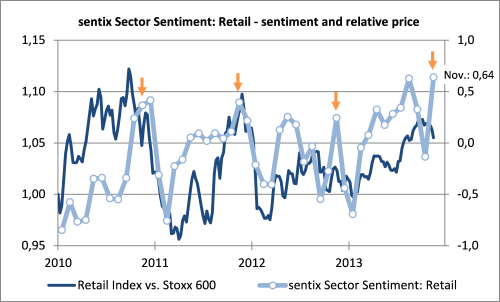

Furthermore, sentix Sector Sentiment for retailing is up strongly in November. It improves by 0.77 points which is its strongest increase since the launch of the indicator in 2001. In addition, at 0.64 points it has now reached an all-time high. Our impression is that investors are anticipating strong Christmas sales. That has been the case in previous years, too (graph). Possibly, investors have here been repeatedly victim of the "availability bias": on their search for points for the sector they may have grabbed the readily available Christmas sales topic – as Christmas sales are about to enter their most intense phase these days. But this idea may soon prove wrong as, in the previous three years, retail stocks have underperformed in the following months – an indication that the good sentiment may have been each time tilted to the upside because the "availability bias" was at work.

Background:

The current sentix Sector Sentiment survey was conducted from November 14 to November 16, 2013. 915 individual and institutional investors took part in it.

sentix Sector sentiment is a monthly survey which is conducted since 2001 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. A value of +1 for a sector means, for instance, that the expectations for the sector stand one standard deviation above the mean over all sectors.