|

20 January 2019

Posted in

Special research

Swiss equities have been among the above-average stocks in recent weeks. And this, even though the majority of shares corrected here as well. Nevertheless, the defensive nature of the Swiss stock exchange proved to be condu-cive to stability. This leads to a very positive investor sentiment.

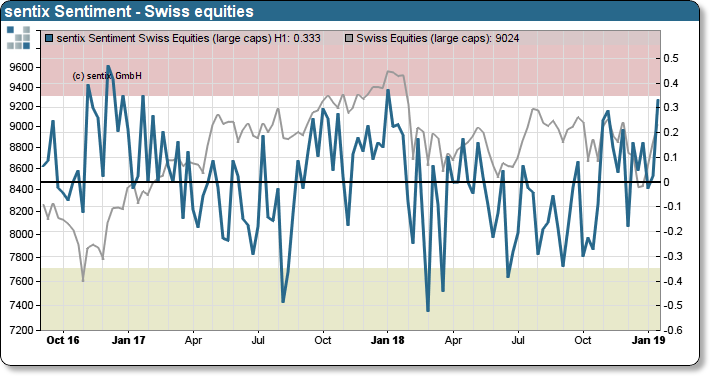

Investor sentiment towards Swiss equities has risen sharply as a result of the recent positive price trend. The sentix sentiment barometer quotes at 33.3%. This is the highest value since the beginning of 2018, but the chart below signals that investors should also act more cautiously in the short term. Because if the stimulation is so good, setbacks are usu-ally not far away.

sentix Sentiment – Swiss equities

This is all the more true since the second level of observation – the strategic bias - does not follow. A market that lacks basic confidence is above-averagely risky. This is because there is a latent willingness to sell in the event of weak or de-clining basic confidence. At present, this basic trust is around the zero line.

So, there are several reasons not to act too carelessly with Swiss equities.