|

24 February 2014

Posted in

Special research

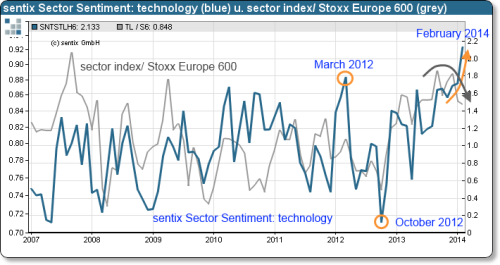

In February, sentix Sector Sentiment for European technology stocks climbs to an all-time high. But the relative performance of Europe's tech stocks does currently not justify the extremely good mood. Probably, the US-American hype surrounding the take-over of the messenger service WhatsApp by Facebook has had an impact also on the old continent.

This month, sentix Sector Sentiment for European technology stocks increases by 0.42 and reaches an all-time high at 2.13. The former indicator high dates from March 2012 (see graph) which was just a month after the US company Facebook had announced its plans for going public. This time, too, Facebook, although an US firm, seems to be the main driver behind the new record reading in Europe's technology sentiment. Last week the operator of the world's largest social network said that it was going to buy the messenger service WhatsApp for about 19 billion US dollars. This news should have had a positive influence on the perception of the European tech segment as well.

At the same time, the relative performance of the European tech sector is falling since the end of last year. Obviously, tech stocks have become an investors' darling – which is underperforming stocks that nevertheless are very popular. The massive media coverage of Facebook's planned transaction should have helped in this process and probably has blurred investors' realities. But when market participants will become aware of the underperformance of the European sector, they will probably turn their backs at it. This should weigh on the prices of technology stocks in the coming weeks.

Background:

The current sentix Sector Sentiment survey was conducted from February 20 to February 22, 2014. 942 individual and institutional investors took part in it.

sentix Sector sentiment is a monthly survey which is conducted since 2001 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. A value of +1 for a sector means, for instance, that the expectations for the sector stand one standard deviation above the mean over all sectors.