The comeback of inflation? sentix index signals a trend reversal!

Written by Sebastian Wanke

|

09 March 2015

Posted in

Special research

The latest sentix indices show a very remarkable development: because of the ECB’s aggressive monetary policy investors expect any increase in yields to be prevented. The same investors also think that inflation will pick up soon. Obviously they ignore the consequences of a return of inflation for the bond markets. This is a risk.

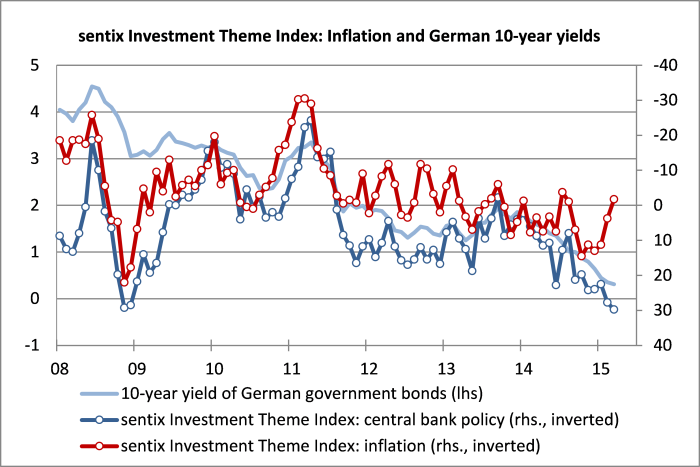

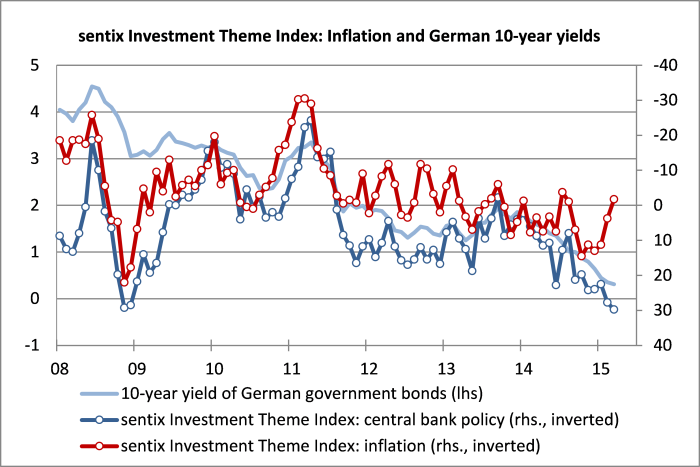

In March, the sentix Investment Theme Indices which are surveyed on a monthly basis for bond markets display some interesting developments. On the one hand, they demonstrate that investors expect the ECB’s policy to (still) have a strongly dampening effect on yields in the weeks to come (see graph, blue line). On the other hand, they think that deflationary tendencies will end and that inflation will return to the euro-area. The corresponding sentix index has completed its turnaround this month (see graph, red line).

Bond investors seem to ignore this so far, probably because they expect the ECB to prevent any rise in yields by its current buying programme. But the “QE” experience from the US is different. The “Fed” has managed regularly to drive yields up by its purchasing activities – as higher yields are part of an economic normalisation process to which, in turn, belongs higher inflation.

Whatever might be the real reasons behind investors not expecting yields to rise the development described above represents an important risk factor for bond markets. Rising inflation expectations usually lead – sooner or later – to rising bond yields!

Background

The sentix Investment Theme Index which is surveyed among investors on a monthly basis (around the first Friday of each month) is a measure for the topics that will drive the bond markets in the coming weeks. Consequently, the indices can be used as short- to medium-term forecasting and as timing tools for European bond markets, including the German one. Five single topics are surveyed: “inflation”, “economy”, “currency trends”, “central bank policy” and “fiscal policy”. Out of these a composite index, the “sentix Theme Barometer Bond Market”, is constructed mirroring in a concentrated fashion trends on the European bond market.

For the “sentix Investment Theme Index: inflation” investors are asked about their assessments on the future influence of inflation on the prices for European bonds. The idea behind this indicator is that rising inflation expectations usually lead to higher yields (lower bond prices) – and vice versa. The index is – as the other “Theme Indices” – constructed in such a way that it points to higher bond prices when it rises. A rising indicator thus signals lower inflation expectations or increasing deflationary expectations. This is why in the graph above both “Theme Indices” are display in an inverted manner.

The “sentix Investment Theme Index: central bank policy” is surveyed by asking investors if they think that the central bank policy will play a bullish or a bearish role for European bond markets in the near future. The idea here is that central banks can – via their interest rate policy, via quantitative measures or their forward guidance – influence money and capital markets decisively.

The current survey was conducted from March 5 to March 7, 2015. 1025 individual and institutional investors participated.