|

16 January 2017

Posted in

Special research

The sentix Sector Sentiment for European pharmaceutical stocks has hit the lowest level since 12 years ago. Within only a few weeks, investors’ perception has turned upside down. The latest remarks by president-elect Trump on drug pricing in the US has stirred up investors’ confidence. A short-term buying opportunity could arise.

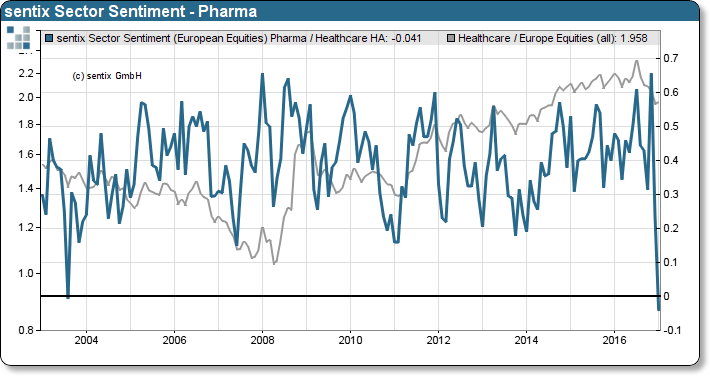

The “Twitter diplomacy” of US president-elect Trump does scare not only executives of companies planning to invest in Mexico but also investors in pharmaceutical stocks. After nearly five years of persistent outperformance of Europe-an STOXX 600 Pharmaceutical and healthcare stocks, investors have lately shown lots of sympathies. Hence, investors react so much more sensible towards negative commentary. While president-elect Trump unloaded his resentment towards the price bidding procedure for drugs in the US onto media at his second official press conference after the election, investors got terrified. The notion that a President Trump would introduce price ceilings depresses investors sentiment towards pharma companies. The sentix Sector Sentiment plummets to the lowest level since 2002, only weeks after an all-time high. Investors (especially institutional investors) now assess the industry’s medium-term outlook rather pessimistic (see chart below).

Comparable sentiment drops, however, tend to result in no significant further price corrections. Due to its composition, the sentix Sector Sentiment does not only incorporate investors’ valuation towards an equity sector but also a standard sentiment component. As the latest shock is most likely fear driven, investors should prepare for an upside surprise of European pharmaceutical stocks. Extreme sentiment values are contrarian buy signals.