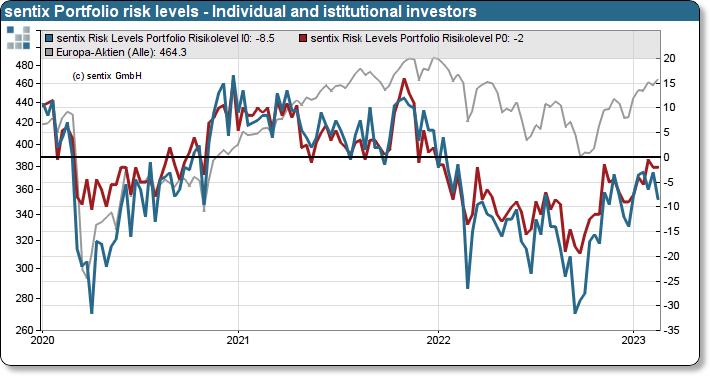

sentix Risk Levels

The sentix Risk Levels provide an indication of the sum of portfolio risks in investors' portfolios. To this end, we ask market participants on a weekly basis whether they hold above-average or below-average portfolio risks.

The question deliberately focuses on an abstract concept of risk, i.e. the source of the risks cannot be clearly determined. Thus, the index always reflects the subjective investor perception of the risk incurred, regardless of the source of the risk. Users of the data should therefore always also consider the monthly data on the positioning behaviour of investors in the individual asset classes as a reference variable.

The risk level data cannot be provided on Bloomberg under the tickers "RISKxxxx". For this reason, the respective data of this group from the third week of a month are published under the tickers "SNTZRLxx" in parallel to the data of the sentix risk aversion as a monthly time series.

Specifications

- Code: RISK

- No. Serien: 2

- Start: 2015-06-09

- Rhythm.: weekly

- Fristigkeit: Lage

- Investor: Institutionelle, Privatanleger

Customer Feedback (0)