|

30 June 2014

Posted in

sentix Euro Break-up Index News

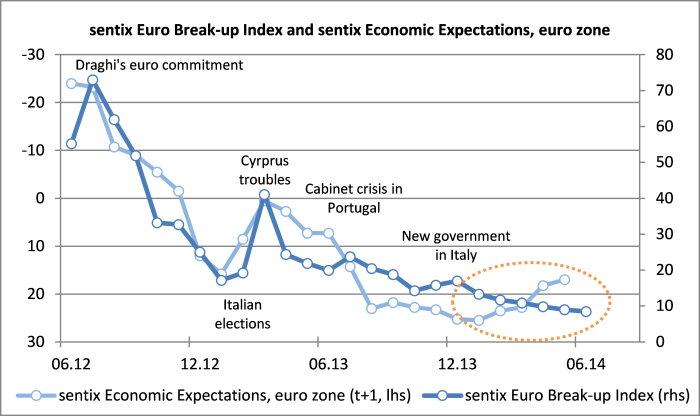

The sentix Euro Break-up Index (EBI) falls for a sixth straight month. In June, it decreases from 9.0% to 8.5%. Over the last two years investors have never been so optimistic regarding the euro's future. But at the same time investors' economic expectations have been weakening recently. And a slowdown in economic activity could well lead to renewed fears concerning a euro break-up. This possibility is obviously ruled out by investors at the current juncture.

The sentix EBI's decrease can this time, on the one hand, be explained by the fact that, once more, less investors expect the two special cases Greece (6.4% after 6.7%) and Cyprus (3.3% after 3.7%) to exit the euro within the next twelve month. On the other hand, euro-exit expectations for Germany also drop markedly from 1.7% to 1.1%. Last month the European elections had drawn investors' attention to this topic which is also one for Germany. In June, this effect has completely faded.

Except for Greece and Cyprus, the national sentix EBI now all range in an interval up to just below 2%. Within this range their movements have become relatively small. Consequently, a further tightening of spreads between the so-called periphery countries and German Bunds can barely be explained by further fading euro break-up fears. On the contrary, for investors the question from now on is: Where should spreads stand now that the crisis is over? This is all the more interesting as the "old spread model" one could observe before the crisis obviously has not been a sustainable one.

Nevertheless, there is still one remarkable development in the EBI data this month worth mentioning when thinking of spreads: The difference between the national EBI for Italy and the one for Portugal grows! While the Italian EBI increases against the general trend (from 1.5% to 1.8%), the Portuguese EBI recedes a little (from 0.6% to 0.5%) in June. As a result, Portuguese bonds look still rather cheap relative to their Italian counterparts. Here, the national EBI point to a further compression in the spread of the government bonds of these two countries.

Overall, the sentix EBI draws – as in the previous months – a picture that does not look like crisis anymore. At the same time, investors' expectations (as measured by the sentix economic index) also recede for some time already (see graph). And a weaker economy could well make euro-break-up fears resurface. Against the background of, among other things, politicians' announcements to interpret the European Stability Pact more flexibly in the future, investors seem to rule out such a scenario at the current juncture. But if economic expectations failed to stabilise in the coming months, this complacency could easily become a burden for the developments at the spreads market for euro-zone government bonds.

Annotation relating to the graph: sentix Economic Expectations are inverted. Furthermore, all readings of the sentix Economic Expectations time series are shifted to a month earlier as this leads to a better fit of the survey periods of both indices. The next sentix Economic Index for July will, for instance, be published next week already, just one week after the sentix EBI for June.