|

08 September 2015

Posted in

Special research

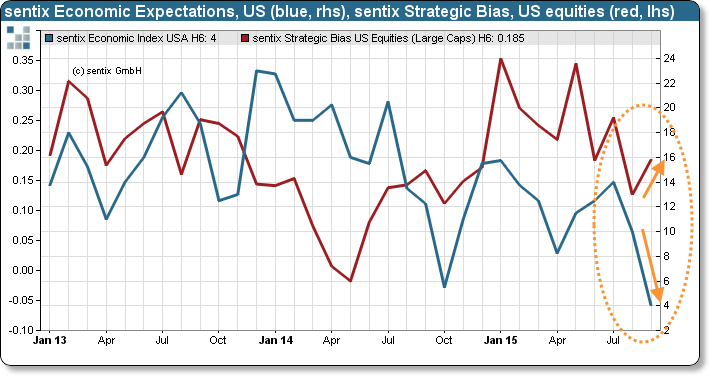

The latest sentix data set reveals an alarming discrepancy: investors’ fundamental belief in equity prices is still rising despite falling economic expectations. Potential risks are especially lurking in the US market. Investors are turning a blind eye on possible adverse effects for equities as economic optimism fades.

The sentix Economic Index for September drops significantly for all major markets and regions. Notably expectations of economic acceleration are on the decline. Such drops in investors’ expectations are usually early warning signs for declining equity markets. By itself, economic expectations convey an alarming message. However, in combination with results shown by the sentix Strategic Bias for equities, which aims at capturing investors’ fundamental belief in equities, the signal is even more puzzling. Strategic Bias rises, especially for US markets (see figure).

Discrepancies of such magnitude reflect serious risks. Though, rising skepticism about economic expectations has not raised investors’ awareness regarding equity price developments – investors still perceive an engagement in equities as an investment without alternative. Moreover, investors’ blind trust in the power of central bank interventionism is threatening. Would behavior be consistent with expectations should reactions follow suit – with negative consequences for equity price developments.