|

24 May 2016

Posted in

Special research

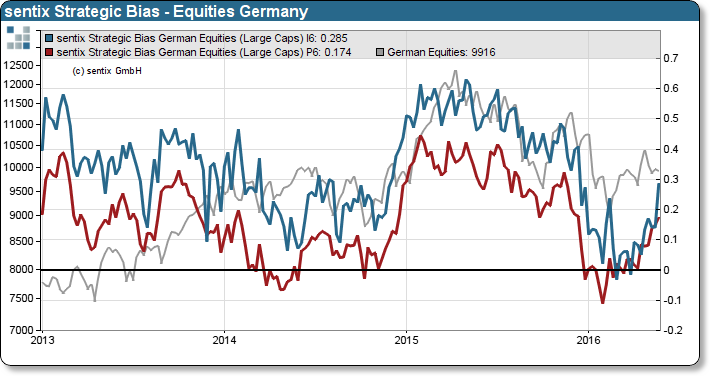

The latest sentix Global Investor Survey reveals an exceptionally positive signal for the German equity market. The prospects for a new bull market are increasing as especially the medium-term market expectation of institutional investors is on the rise.

The sentix Strategic Bias rises to a new 13 weeks high as it expresses regained medium-term conviction of German equities. Especially institutional investors’ confidence gets a boost. The sub-index rises 13 points in comparison to previous weeks’ survey. It is in principle a bullish market indication. However, it contradicts the conventional market wisdom “sell in May”.

“Sell in May” describes the tendency of some investors to avoid period from May to October. In contrast, the increase of the sentix Strategic Bias points out that investors mentally prepare to buy instead to sell (refer to Background for a detailed explanation). Rising confidence, especially among institutional investors, is “apparently” neither caused by price indication nor by the news. Therefore, the latest signal should be taken seriously as emotions obviously were not the cause. Based on our statistical analysis, investors can theoretically expect an increase of around 2.3% over the next 16 weeks, on average, each time investors’ confidence has reached a comparable level.