|

04 August 2015

Posted in

Special research

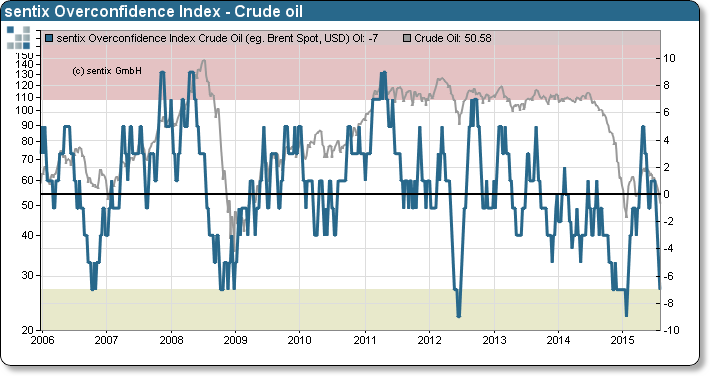

Since early May, oil prices have come under pressure again. Meanwhile, the lows from the beginning of the year have been reached again. This has not only pushed the sentiment to a bearish extreme but now also means that investors tend to extrapolate the negative trend. The sentix Overconfidence Index indicates this. This could support the oil prices in the short term.

The sentiment on the oil market has slumped in recent weeks and has recently reached bearish extremes. That alone is a strongly reminiscent of the recent downturn in the oil market by December 2014 and January 2015. However, a negative sentiment alone is usually not a sufficient indication of a lower turning point. Two other factors are in addi-tion usually: An inclination of the investors to extrapolate the trend and a correspondingly bearish investor positioning.

The sentix Overconfidence index has now reached a value of -7. That indicates that investors tend to extrapolate the downward trend in oil prices. The second condition for a low in oil market is therefore achieved. However, a major difference from the last low in oil prices remains: the investor positioning. The long position of investors has indeed de-creased substantially in the past weeks but the position degradation went not so far as in January. Nevertheless, a low in the oil price is now closer than before.