|

16 October 2013

Posted in

Special research

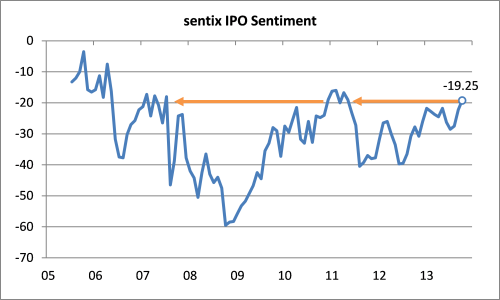

European investors are getting more and more interested in Initial Public Offerings again: The sentix IPO Sentiment rises in October by three to now -19.25 points. This is its highest reading since April 2011 and its third increase in a row after a so far rather uninspiring year of 2013.

The rising sentix IPO Sentiment underscores the current optimism for European stock markets. The positive mood is not only reflected by rising stock prices, but also mirrored in a number of other sentix indicators. Our wide-ranging sentix data pool in sum points to a good stock market performance for still some time which, in turn, represents an adequate environment for IPOs. Consequently, investors again show increasing readiness to pick up new issues.

The development of the indicator is a reminder of the potential which European stock markets bear. While sentix IPO Sentiment has reached its highest reading for two and a half years now, it still shows clearly negative value. That means that the majority of investors, as before, prefers to invest in other asset classes rather than to get involved in IPOs. Interestingly, since the start of the survey in July 2005 the index has never managed to enter positive territory. Its highest reading so far was recorded in October 2005 with -3.5 points.

Background:

sentix IPO Sentiment is surveyed on a monthly basis and part of the sentix Asset Class Sentiment survey which is regularly conducted around the second Friday of each month. Participants may choose from a range of 1 to 5 in order to show how inclined they are towards IPOs in relation to other asset classes. The indicator may fluctuate between -100 and +100 where the third category of the given range marks its zero line.

The current survey was conducted from October 10 to October 12, 2013. 925 investors (of which 241 institutional investors) took part in it.