|

11 July 2016

Posted in

Special research

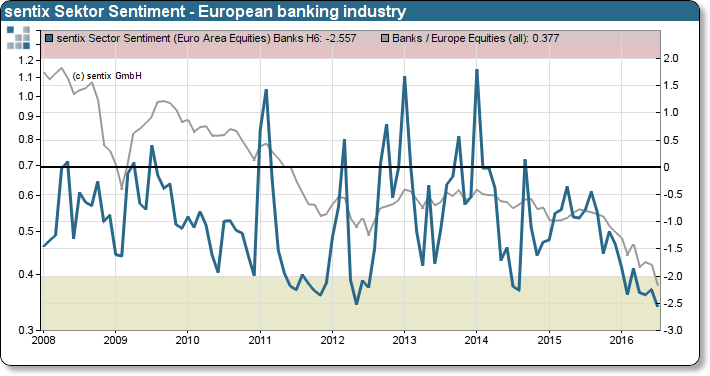

The European banking crisis worsens in the wake of the Brexit referendum. The sentix Sector Sentiment marks a new all-time-low. However, investors’ impression has reached such an extreme negative value that it could represent a contrarian buy opportunity.

The sentix sector sentiment for European bank stocks has fallen to -2.55 index points. It is the lowest ever recorded value since the inception of the sentix indicator in 2002. Meanwhile, pessimism has reached such a negative magnitude that even exceeds the negative magnitude of 2012 (refer to the chart below). We all remember: Back in 2012 Mr Draghi was forced to give his famous speech “whatever it takes” to strengthen the European banking sector and the euro. Today, four years later, the banking industry once again teeters on the brink of the abyss. Investors express their concern, in line with pessimistic media response, that a new policy is necessary to solve the crisis.

The sentix Sector Sentiment could provide investors with guidance: As falling indicator values lead in principle to weaker sector performance, however, sentiment readings below -2.0 standard deviations usually precede rising asset prices. Investors willing to dump their holdings usually have done so, as values reach extremely negative territory, thus, reducing downward price pressure.Based on a behavioural finance point of view, investors’ current pessimism could evolve into a potential buying opportunity.