|

21 November 2016

Posted in

Special research

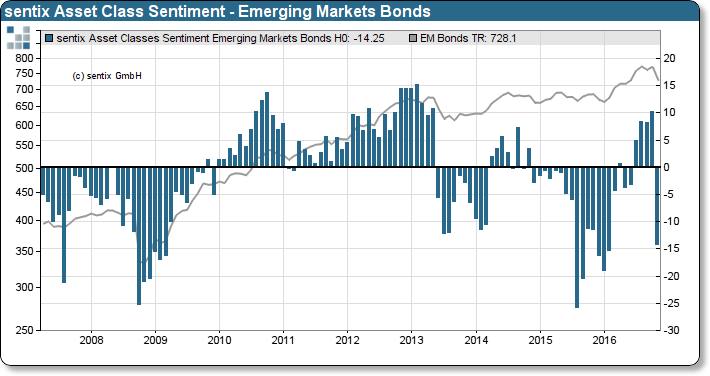

The monthly gauge of investors’ sentiment on emerging markets bonds plunges into negative territory. However, the stark contrast to previous month’s sentiment does not signal an upcoming bear market.

In November, investors shun their just recently rediscovered passion for emerging market bonds. After a brief period of positive mood, sentiment drops significantly by -24.5 points to an almost new annual low at -14.25 points. Surging fears that a policy shift of the incoming US administration could cause a rise in inflation, trade conflicts as well as a tighter monetary policy, dampen investors’ appetite for emerging markets bonds. Based on the JP Morgan EMBI Global Total Return Index, in the wake of the US presidential election Emerging Markets Bonds have lost up to -5.7% in value.

Nevertheless, the Emerging Markets bond rout has already lost gear. The -24.5 point sentiment decline within such a short period is a panic indicator. Typically, such stark drops sentiment signal the end of a trend. Therefore, we do not expect a bear market in emerging markets bonds.