|

15 February 2016

Posted in

Special research

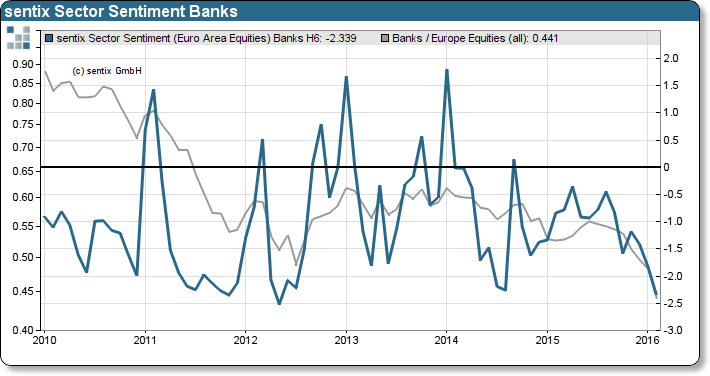

The sentix Sector Sentiment Index documents a strong deteriorated investor sentiment for European Bank stocks. The mood is on a 24-month low. This results in a tactical buy opportunity.

The sentix Sector Sentiment Index for European Bank stocks tumbles further and now quotes at -2.3 index points on a 24-month low. Comparable values were measured only during the euro crisis 2011/12, and in the late summer 2014 (see chart). The sector sentiment measures the 6-month expectations of investors in relation to the Stoxx 600 sector and is an indication for the sector’s future performance.

Lately, the negative developments at Deutsche Bank AG should have considerably accounted for the gloomy investor sentiment.This has impacted the whole industry and contributed to an underperformance" of the banking sector in recent weeks.The current sentiment extreme shows, however, that the vast majority of investors have already turned their back on bank stocks.This is usually a sign that relative performance is on the cusp of rising again. For couching investors, the negative sentiment extreme indicates a contrarian buy opportunity.