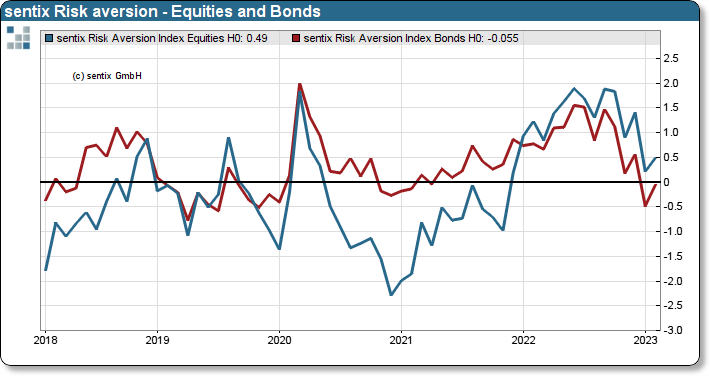

sentix Risk aversion index

The sentix Risk Aversion Index is calculated and normalised from various sub-areas of the senix Styles and shows the extent to which investors seek or avoid risks in their portfolios. The indices are derived from the sub-indices on the risk aversion of investors in the Styles group and represent these as z-scores. In addition, the scale is inverted, as a high index reflects a high aversion. The indices supplement the sentix Risk Levels with a monthly, more precise measurement.

A detailed presentation of the included sub-indices can be found in the Styles Compendium.

The idea behind these indices is to make it easier to compare the indicators by standardising them as z-scores. In addition, other "aversion" indices are available on the market that are derived from market data. With these indicators, the sentix risk aversion indices are more comparable due to the inverted scale compared to the risk propensity indicators.

The indices with the code SNTZRLxx represent the values from the third week of a month of the RISK family. Since the RISK family data cannot be provided on Bloomberg, a data point is provided at least once a month via this diversions.

Specifications

- Code: SNTZ

- No. Serien: 18

- Start: 2004-02-05

- Rhythm.: monthly

- Fristigkeit: Lage

- Investor: Institutionelle, Privatanleger, Headline Index

Customer Feedback (0)